It’s about halfway between closing our application cycle in April and announcing our next cohort in October, which marks the time for our annual pipeline report. Over the years we’ve recognized that our pipeline process doesn’t just give us a pool from which we select the next cohort of startups that will go through our program. It also gives us a wide lens for the trends that are shaping the climate tech world.

Led by our Directors of Innovation, and in collaboration with our ecosystem of industry and community partners, we’ve been diligently working to select the most impactful companies from the nearly 800 applicants we received for the second year in a row. We started this process with our eyes set, as always, on the mounting climate crisis and its compounding stresses on the systems that underpin our economy. And then the world turned, with millions suffering from a pandemic, tens of millions out of work, supply chains under stress, demand for local food and goods skyrocketing, and city streets cleared out of traffic. It is a sobering reminder that threats that might seem abstract can become devastating crises at warp speed. It is also a reminder of why we remain focused on our mission of combating climate change with every tool at our disposal.

Here, we’d like to share with you some high-level data from our pipeline, and explore a few things we’re learning about what’s shaping the future of energy, mobility, water, food, and the circular economy.

So, who applied to be a part of Cohort 9?

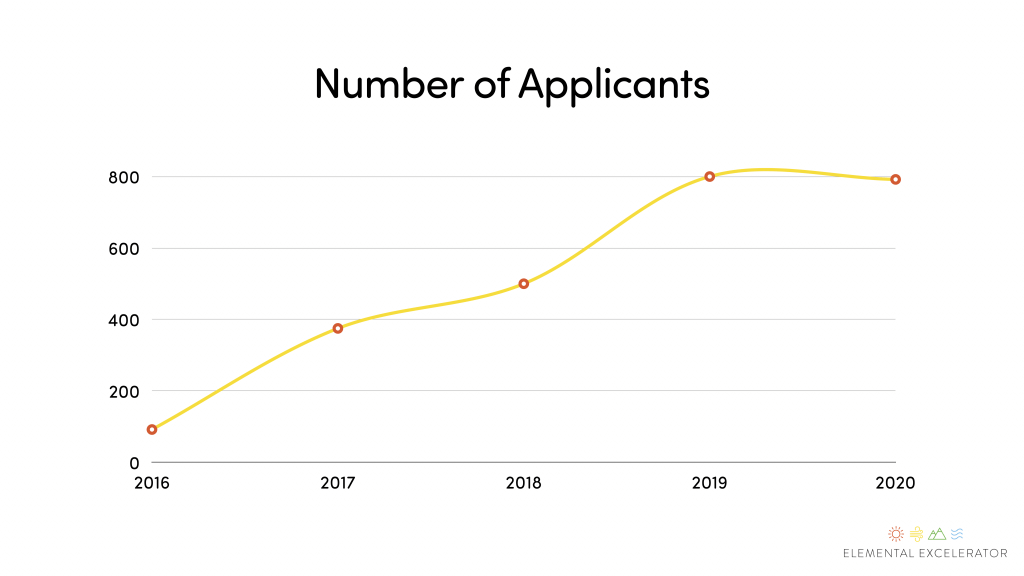

We had 792 applicants from 54 different countries, 60% of which were new.

Even though our application deadline coincided with the beginning of the coronavirus pandemic, we were encouraged to see just as many applicants as last year. Despite investors and startups acknowledging the need to “tap the brakes” as supply chains were disrupted and potential customers halted spending, our applicant pool and portfolio companies (alongside notable climate-related investment pledges from the likes of Amazon, Apple, Microsoft, Unilever, and others) provide evidence that climate tech startups are remarkably resilient, and their innovations are more relevant than ever. In fact, from Numina’s curb-level data collection helping cities develop insights into social distancing and mobility behaviors to Kando’s wastewater monitoring technology helping to detect and pinpoint the source of coronavirus outbreaks, it’s clear that climate innovation and public health often go hand-in-hand.

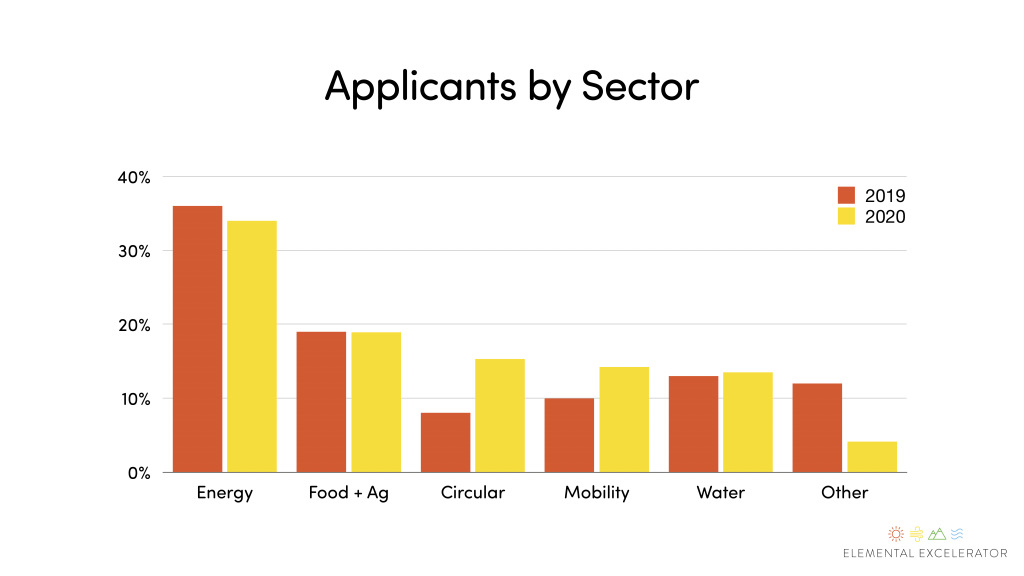

We saw a more industry diverse spread of applicants with the biggest increases in applicants from the mobility and circular economy sectors.

What’s shaping the future of the sectors we work in?

We asked our Directors of Innovation to weigh in on notable trends shaping their respective industries, including the impact of COVID-19. Here’s what they had to say.

🚌 Mobility 🚌

As transportation accounts for around 28% of GHG emissions, we continue to see this as one of the areas most ripe for innovation, with many promising solutions around vehicle electrification (beyond just cars), making freight and logistics more efficient, reducing the overall number of vehicles through transit alternatives and congestion management solutions, and making smart cities a reality through more robust data insights.

Danielle J. Harris, Director of Mobility Innovation, says that the biggest open question in the transportation industry is around new stimulus funds, which could reach into the hundreds of billions over the next five years. “Will those funds be focused on returning to the status quo by maintaining existing infrastructure and transit service? Or will these funds be more visionary and help create a better future for mobility? This could be our opportunity to build out EV charging infrastructure and conquer range anxiety, or finance new projects to compete with European and Asian standards for roads, bridges, waterways, ports, rails, airports, and public transit. Investing in these areas can jumpstart our economy while regaining lost ground in our ability to move goods and our workforce.”

Danielle also believes we will enter a new era of smart cities, helping cities increase efficiency with constrained resources while also empowering them to be nimble as they define the “next normal” of city dwelling. “For many cities, the immense infrastructure lift to become a smart city — sensors, cameras, data management — is overwhelming and requires restrictively high capital investments. However, with COVID-19 and the urgent need for contact tracing (and broadband), we see a push to install this previously ‘luxury’ infrastructure. It’s a huge procurement for cities, which is forcing them to break down a lot of barriers to adopting new technologies. It’s definitely possible that we will look back at COVID-19 as the key that unlocked smart cities.”

♻️ Circular Economy ♻️

Circular economy has rapidly become one of the most exciting areas for innovation, and the growth of materials and other circular companies in our pipeline reflects an increased awareness of the environmental impacts of fast fashion, plastic packaging, and building materials. In fact, while about half of GHG emissions are related to energy and transportation, 45% come from other areas that are more complex to reinvent, such as the production of vehicles, materials, food, and products we use every day. That’s why we take a systems-based approach and focus on technologies that support reuse or create valuable products derived from waste streams.

The circular economy will be increasingly driven by data, says Danya Hakeem, our Director of Innovation for Agriculture and Circular Economy. “There’s a huge need for innovation with localization becoming more and more attractive, and companies looking to source, manufacture, and produce products closer to market. You can’t really have transparency, localization, and automation without the digitization of systems. We’re seeing some really interesting tech providing more accurate data on the availability and condition of products.”

Danya says that COVID-19 has exposed a lot of the broken systems that underpin our economy. “While the transition to a circular economy is more relevant than ever, it’s also more challenging. Concerns about safety and cross-contamination have already caused delays and temporary suspensions of single-use plastic bans in places like New Jersey and New Hampshire, and overall heightened demand for bottled water, personal protective equipment, and plastics. This, in turn, is causing a surge in plastic waste in our environment, as evidenced by masks and gloves washing up across Hawaii’s beaches. It’s critical that we don’t lose momentum in improving our recycling and waste systems — and, better yet, support innovations that can eliminate petroleum-based plastics altogether.”

⚡ Energy ⚡

Energy remains the largest share of our applicant pool, and we continue to see a lot of companies working on storage, battery chemistry, and grid tech, as well as many IOT and customer-facing solutions. Compared to the last couple of years, there was a continued drop in energy generation companies (as clean kWh hours have increasingly become an inexpensive commodity), and a surge of companies incorporating artificial intelligence and machine learning, reflecting what has become an increasingly crowded, fast-moving, and competitive space across the energy industry.

Nneka Uzoh, Director of Energy Innovation, notes a trend in how climate-related policies are reaching from the public to the private sphere, and influencing the way that companies are building out new products. “Globally, we are seeing new mandates around things like net-zero buildings, electric vehicles, and energy storage, not just for cities, states, and countries but also for corporations. We’re seeing a lot more companies rising up and securing investments to meet the challenge of helping non-utilities meet their decarbonization goals.”

“The coronavirus pandemic has a lot of companies rethinking everything from hardware and product deployment to customer engagement and asset management,” Nneka says. “What does the future of product deployment look like when you can’t go to people’s homes? What does customer engagement look like when you can’t shake a hand? What does asset management look like when it’s harder to run trucks up and down your service territory?”

💧 Water 💧

While the widespread adoption of innovation in the water sector is still emergent, there is an enormous opportunity for innovation stemming from the sector’s complex systems and antiquated processes. This year we saw an increase in solutions that can lower the energy and chemical footprints for water collection, processing, and distribution. We’re also seeing growth in the number of companies working to address water access issues through unique financing platforms and service-oriented business models.

Decentralized water treatment has become a key trend in the places where we focus our work, says Kim Baker, Director of Water Innovation. “This strong interest in decentralized treatment stems from regulations, partially, but also the recognition that many centralized treatment facilities are at capacity, whether due to expanding population growth or industrial operations that are over capacity.”

Looking ahead, Kim says that there will be a global need to spend around $7-10 trillion on water in the next 15 years. “If that is not a business opportunity, I don’t know what is. And in all likelihood that number has only been amplified with COVID-19. We may start to see cloud-based capabilities around management of employee workflows and process optimization. Utility employees are essential workers and they need as much automation and support for remote work as possible right now, regardless of whether the utility had concrete plans for digitization before 2020.”

🌱 Food & Agriculture 🌱

Agriculture’s role in both causing and helping to mitigate climate change has been gaining more and more attention, and we’re excited to see so many startups in this space whose innovations fit into the World Resources Institute’s five-course menu of solutions that can reduce agricultural emissions by 70%. The largest number of companies were those innovating in farm management and automation — essentially “digital agriculture.” But their overall share of the pool declined by around 20%, reflecting the saturation of the market and the start of some consolidation.

Danya Hakeem, Director of Agriculture & Circular Economy Innovation, says that “massive disruptions in our global food supply chain are exposing a need for decentralized solutions that build resilience. We saw an increase in applicants rising to the occasion, primarily with marketplaces, logistics platforms, and food delivery and food service technologies working to connect farmers directly with sustainability-minded brands and communities in need.”

COVID-19 has accelerated a number of trends that were already shaping the food and agriculture space. “All of us can attest to an elevated consumer consciousness about health, and the role that food plays in turn,” Danya says. “Consumer buying habits have evolved more drastically in the last few months than they have since WWII. Beyond likes on social media, people are supporting local agriculture with their dollars and shifting their diets to plant-based alternatives. We’re interested to see what comes out of this moment and if these shifts will be maintained over time.”

Equity & Access

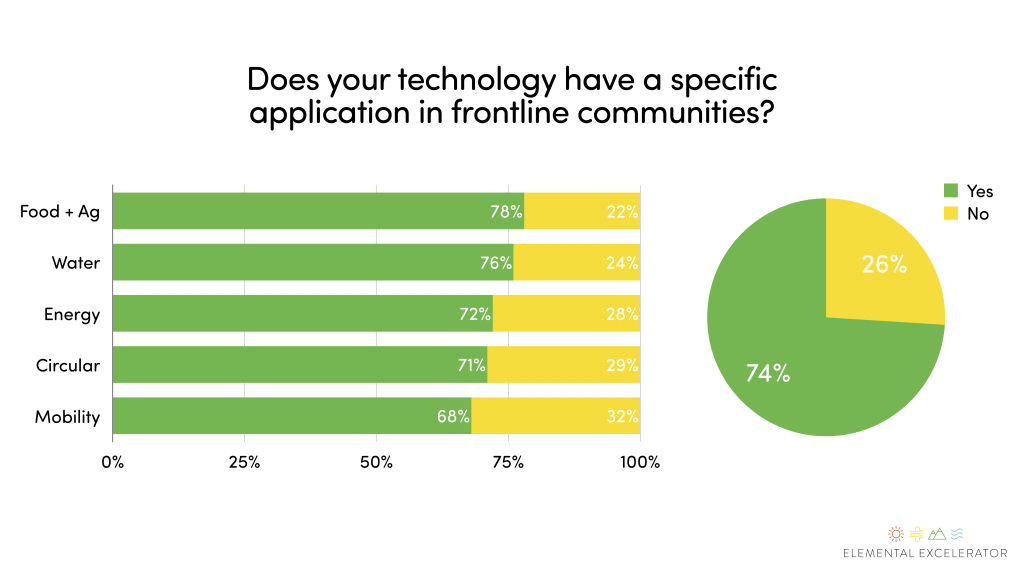

Nearly 30% of this year’s applicants applied to our Equity & Access track, with the rest evenly split between our Demonstration and Go-to-Market tracks. In addition, a whopping 74% of applicants indicated that their technology has a specific application in frontline communities, with food & agriculture companies leading the way. This gap reinforces the opportunity we see in creating resources that can form bridges between frontline communities and the startups we work with.

“Creating products and business models to ensure frontline communities have access to climate-positive innovations continues to be one of the most important opportunities for startups in our pipeline,” says Sara Chandler, our Director of Equity & Access Innovation. “Coupling the twin engines of climate justice and innovation is the surest path to emissions reductions at scale, and ensures that environmental and economic benefits reach the people and communities who need them the most.”

Equity In at Elemental — Founder and executive team diversity

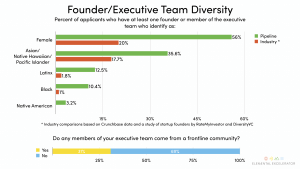

To understand and improve the diversity of the talent pool in our pipeline, we track demographic data around applicants’ founders and executive teams. As part of our partnership with the Kauffman Foundation, we set a goal for 2021 to have at least 30% of our portfolio companies’ CEOs come from under-represented groups in tech, and to specifically recruit founders from these backgrounds.

In terms of gender diversity, 56% of our applicants have a female founder or executive. By comparison, only 20% of global startups raising their first round in 2019 had a female founder. In terms of ethnic diversity, nearly 36% of applicants have founders or executives who are Asian, Native Hawaiian, or Pacific Islander. And 12.5% and 10.4% of applicants have Latinx and Black founders or executives, respectively. All of these outpace industry averages for startups, suggesting that we are in fact reaching a more diverse talent pool by reaching into more diverse communities. Still, we still have a lot of work to do — collectively — toward creating a more equitable entrepreneurial ecosystem.

Moreover, 31% of our applicants indicated that they come from frontlines communities. With our place-based mission, this is a critical metric and underscores our commitment to reach more people and establish lasting, trusted relationships in the communities we invest in.

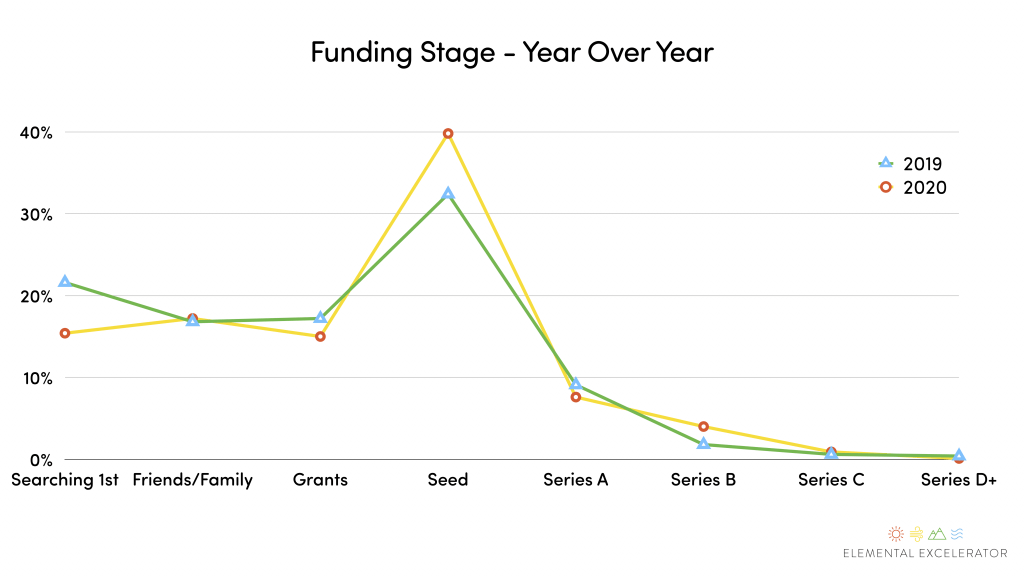

We continue to see a lot of applicants in our “sweet spot” funding stage of Seed to Series B/C

More than 50% of our applicants this year had already raised their seed round, with a significant number also having raised A and B rounds. Comparatively, only about 45% of applicants last year had completed a seed raise (or later). We started Elemental Excelerator to address a critical gap in funding, “The Market Expansion Valley of Death,” that was preventing companies with solid tech from surviving and thriving. Year over year, the distribution within our pipeline affirms that there are many promising seed-stage startups within the climate-tech space who need funding opportunities to prove that they can fully commercialize their technologies.

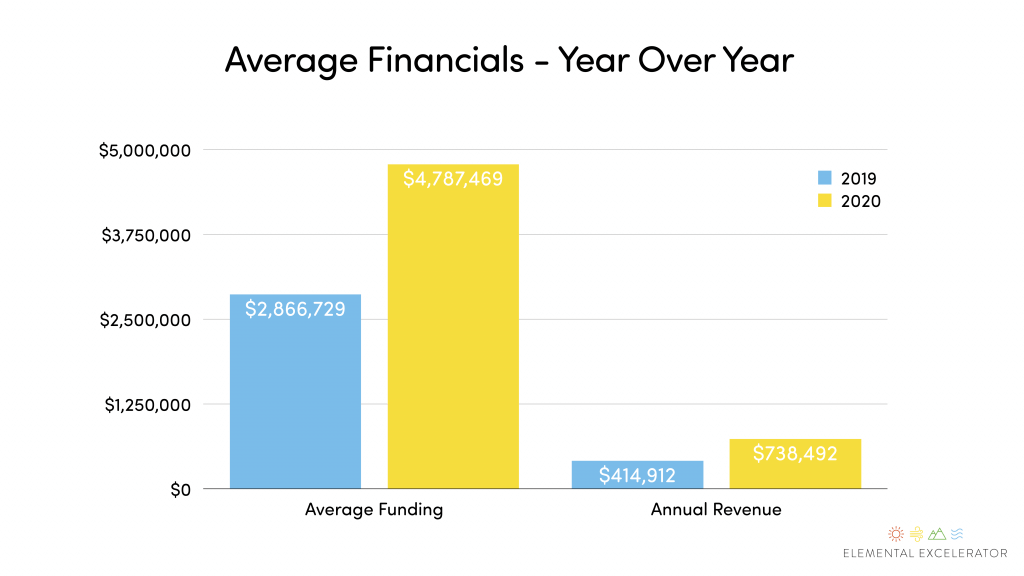

The overall maturity of our applicants has increased significantly, with average funding nearly doubling since last year and average revenue increasing by 78%

What’s interesting here is that these financial indicators are stronger despite the similar spread in funding stage from last year. It’s another signal of the overall maturation of the companies that apply to our program and across the climate-tech sectors that we invest in (and tracks with the broader trend of seed rounds getting bigger and institutional capital moving upstream). This is exciting because companies that are more mature tend to have teams and runways right-sized for deployment and our program, especially in the Demonstration and Equity & Access tracks.

Interested in more data and insights about the trends shaping the future of the climate tech ecosystem? Learn more about partnering with us here.