What’s in a pipeline? For many VCs, it’s the next opportunity to score a massive return. As a nonprofit investor, it’s a bit different here at Elemental. Our applicant pool is where we create a cohort of companies that are poised to maximize climate and social impact, and can learn and help each other through the unique journey of climate tech commercialization. It’s also a window into the industry trends and dynamics that are shaping the climate tech ecosystem.

Over the years we have connected with and learned from thousands of startups working toward a cleaner and more equitable future. This report digs into data from the 515 companies from 46 countries that applied for our 11th cohort, and looks at trends from years past to better understand the changing landscape of climate technology.

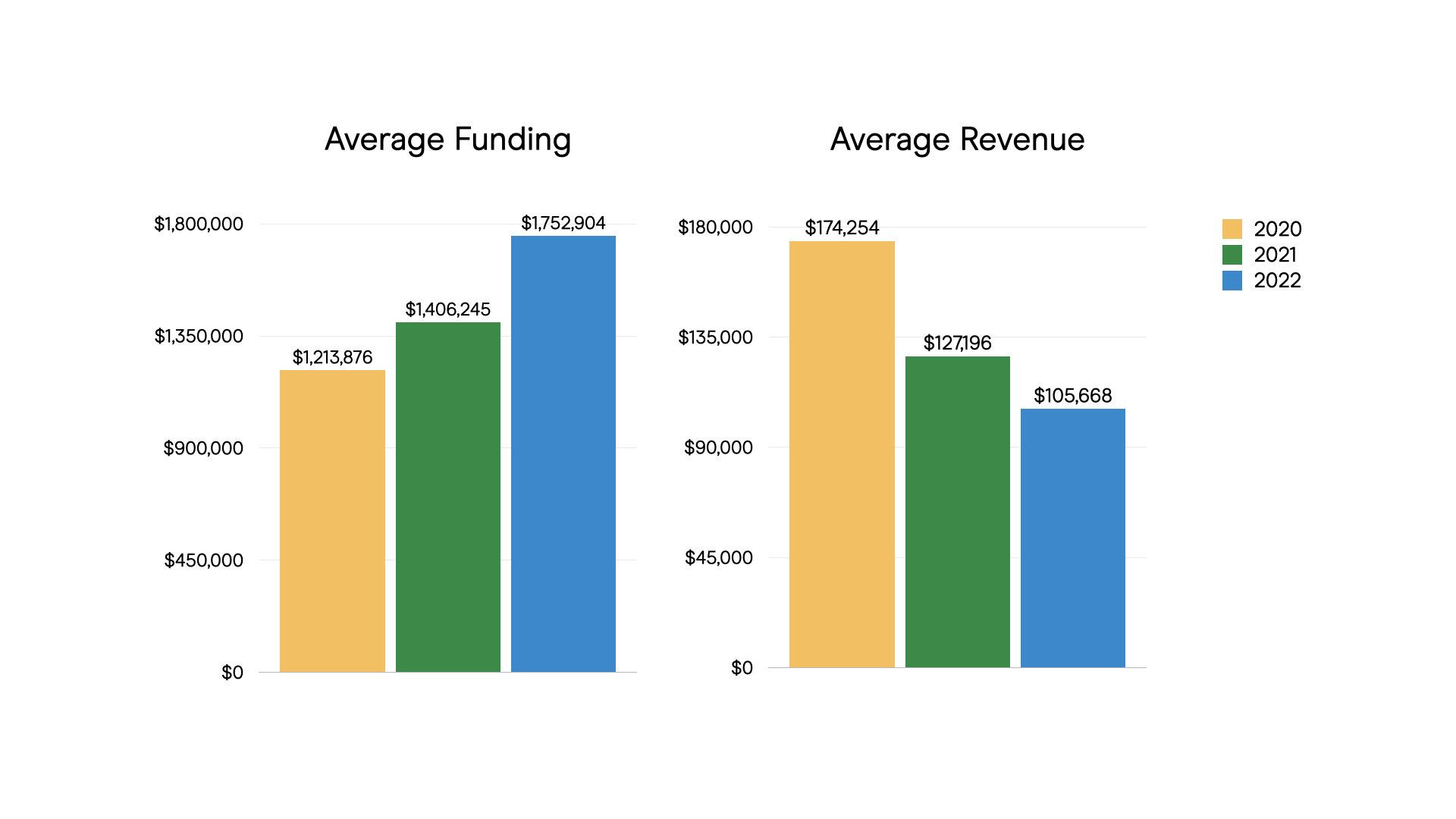

More Money, Less Traction

It’s probably no surprise the majority of climate tech companies we see each year — between 60% and 70% — have been around for fewer than four years.

Companies founded in the last four years had significantly more funding compared to recently founded companies in previous cycles. On average, recently founded companies that applied this year had raised 25% more funding than 2021 applicants, and 44% more funding than 2020 applicants. This is contrasted by the fact that the average revenue of recently founded companies applying this year was down 16% compared to 2021 applicants and 39% lower than 2020 applicants. In other words, earlier-stage companies are starting to raise more money with less commercial traction.

Why is that? Between policy drivers, consumer demand and falling costs, there’s less risk around funding new climate technologies. It’s a one-way street that will help attract even more capital to the space and lead to increased valuations.

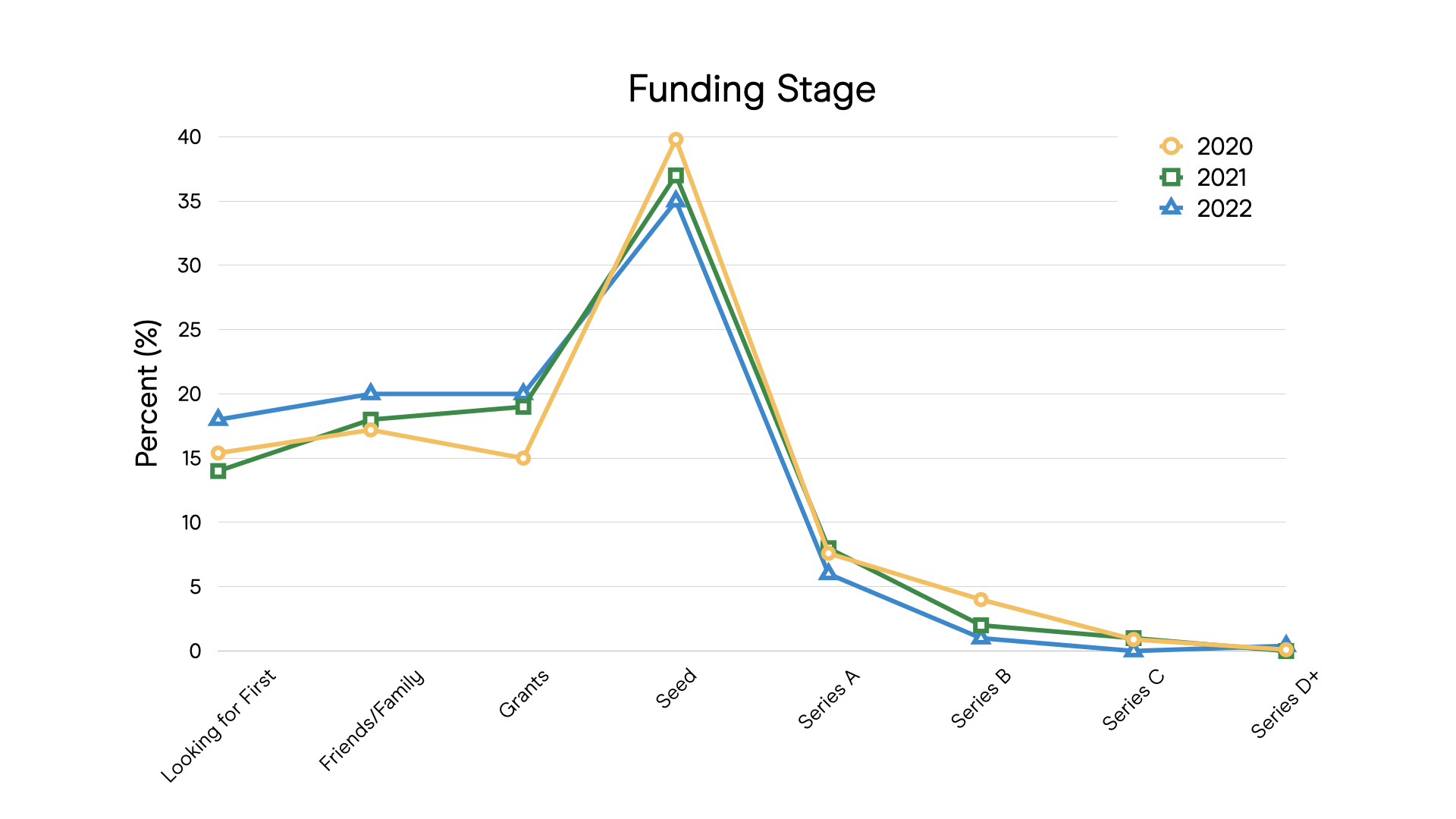

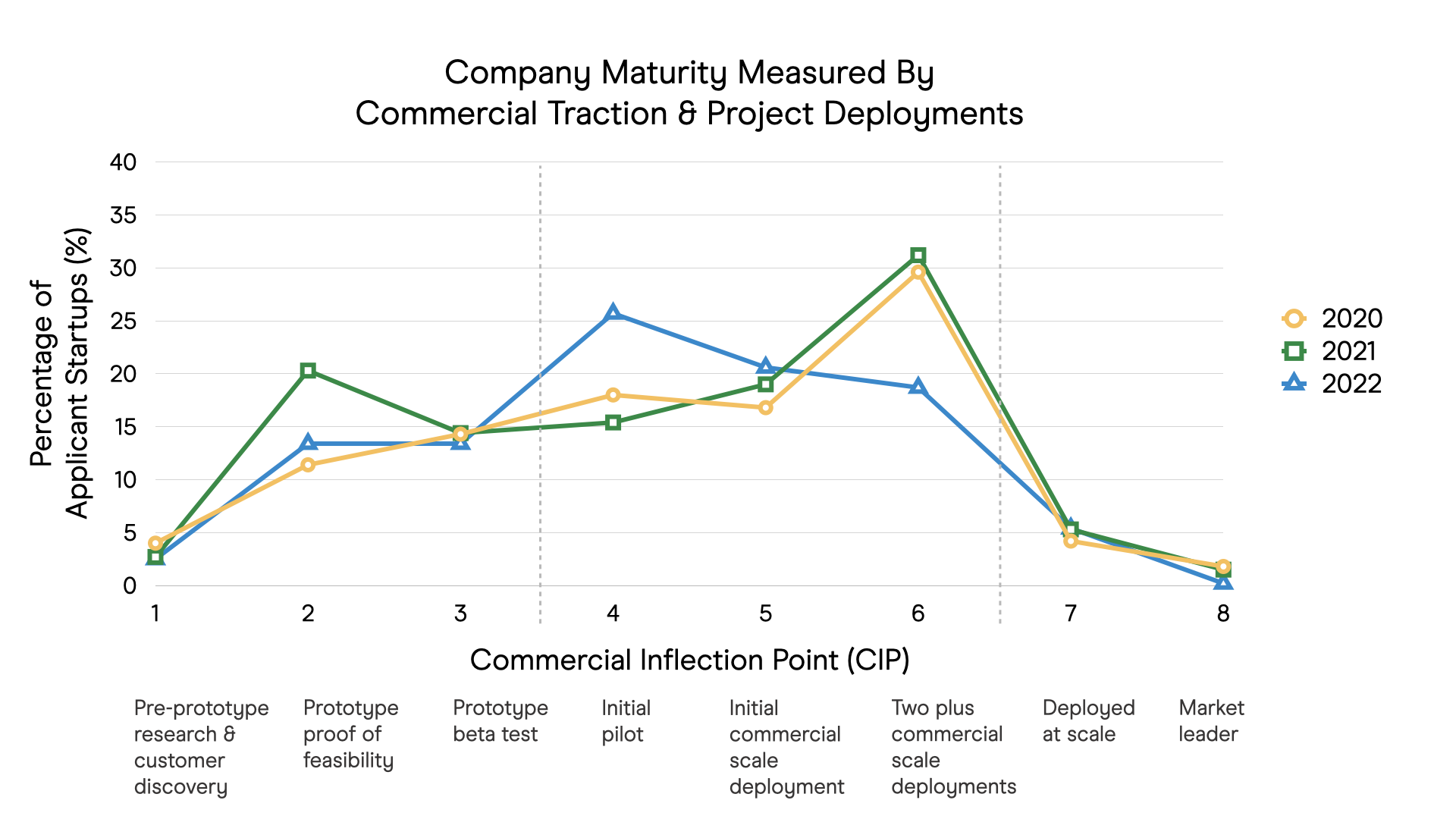

Our pipeline data showing more capital flowing into emerging climate tech companies confirmed that 2021 was a “breakout year” for venture capital climate tech deals. This point is further reinforced when comparing companies’ funding stage to their position on our Commercial Inflection Point scale.

What is the Commercial Inflection Point scale?

To better capture the true journey of a climate startup, Elemental expanded on the Technology Readiness Level scale developed by NASA, which ends at “market introduction” or “launch.” Our climate tech–oriented Commercial Inflection Point (CIP) scale highlights the stages beyond the first deployment all the way through market leadership. The CIP scale measures readiness and growth based on the company’s commercialization and project deployments.

As in years past, the largest proportion of applicants are companies that have most recently raised a seed round. This year, while the fundraising stage breakdowns are largely the same, you’ll notice a shift backward in terms of commercial maturity (as shown on the CIP scale, where 4 indicates “initial pilot” and 6 indicates “two-plus commercial scale deployments”). This shift reinforces the point that companies are hitting fundraising milestones and raising more money with less commercial traction than in previous years.

Of course, funding isn’t everything, which is why it’s important to measure company maturity using tools like the CIP scale that assess commercial readiness.

And while startups may have a shorter path toward getting funded, commercialization isn’t getting any easier, especially as the space gets more crowded.

Startups continue to look to Elemental for support on project deployments and frameworks to scale their businesses while integrating equity and access into the company’s DNA.

• • •

Sector Trends and Future Predictions

What do year-over-year trends within our key investment sectors tell us about the future of climate tech? How do they confirm or challenge the areas we see as ripe for innovation? We asked our Directors of Innovation to weigh in.

Carbon: Beginning of the Rise

Carbon tech companies in our pipeline nearly doubled this year to be over 7% of total companies – and we believe this will increase considerably moving forward.

The latest IPCC reports continue to spread awareness of carbon removal and emphasize the crucial role carbon tech plays in meeting our Paris Agreement targets. And John Doerr’s Speed & Scale framework shows we need technologies capable of removing at least 1 gigaton of CO2 per year by 2025, and 10 gigatons by 2050.

Director of Innovation Mitch Rubin notes the variety of carbon capture and removal solutions are rapidly evolving, but resolving a few key issues around offsets will help give entrepreneurs (and investors) confidence there will be credible markets for carbon management.

Circular Economy: Shifting Upstream

Circular economy company applicants grew from 8% in 2019 to 17% in 2022. This is aligned with rising consumer demand for more sustainable products, as well as pressure for innovation to address supply chain disruptions, which were intensified throughout the pandemic.

Senior Director of Innovation Kim Baker sees a big opportunity for the next wave of circular economy solutions beyond simply getting more mileage out of existing products and materials. Instead, successful companies will pull circularity upstream into the design phase so products are purpose-built for reuse, and create new approaches that serve multiple sectors and applications.

Water: Access Spotlight

Touching on everything from freshwater and stormwater management to flooding, companies focused on water access jumped 8% compared to 2019.

Kim expects this trend to continue through 2023 and beyond, and nods to three things helping to drive the market for new water access technologies: 1) A larger media presence including celebrity advocates like Jason Mamoa, Jaden Smith and entire communities are pitching in to support during various water crises like in Jackson, Mississippi. 2) Corporate involvement, such as Pepsi, Facebook and Kellogg’s water positive pledges. And 3) New funding sources, including $50B from the Infrastructure Investment and Jobs Act, can help startups working to improve access to clean water, especially in frontline communities.

Food & Agriculture: The Alt Protein Scene

Within the food and agriculture sector, we are seeing a rising prevalence of companies developing meat alternatives (3% to 15%) and aquaculture technology (5% to 15%) over a four year span.

Director of Innovation Mitch Rubin expects consumer preferences will continue to shift as awareness grows around issues like agricultural emissions and animal welfare. This growing demand for meat and fish protein substitutes and sustainable aquaculture will drive even more innovation in this space.

Mobility: EVs Yesterday, Today and Tomorrow

Vehicle electrification is hardly a new concept, but its massive prevalence among mobility companies today is no coincidence. We have seen a huge increase — from 5% in 2019 to 40% in 2022 — in the electrification/alternative fuels sub-sector, including companies that focus on hydrogen and biofuels along with EVs.

Director of Innovation Gabriel Scheer says that regulatory pressures — such as California and the EU setting 2035 fossil fuel restrictions — will continue to accrue and help tip EVs into mass adoption. While EVs have clearly entered mainstream consciousness, and are en route to mainstream adoption, the next question is whether supply chains for critical minerals and enabling technologies will be able to keep pace with mainstream demand for EVs. Supporting this growth while managing supply chain pressures will continue to spur innovation across the electrification front.

Complementing this we have seen growth in the sale, rental and use of ebikes and similar micromobility vehicles; indeed, in 2021 electric bikes were the biggest-selling electric vehicles in the U.S. As cities in Europe, in particular, continue to reduce the presence of cars — and as New York and others look to follow suit — we anticipate continued growth in micromobility, and will look to support that growth through charging, parking and related solutions that enable micromobility vehicles to better integrate with the urban fabric.

Energy: Race to Storage

We’ve seen energy storage companies increase from only 11% of 2019 energy applicants to 17% in 2022.

Now that the maturing renewables market has made it cheaper and easier to bring clean energy to the grid, the next big market opportunity is around the ability to store it effectively. Gabriel notes that while lithium-ion batteries have an early lead on deployment, they mostly promise incremental advances. The moment is ripe for other long-duration storage ideas that rely less on rare minerals, new materials or complicated supply chains. Incentives from the Inflation Reduction Act should give those a considerable boost.

In Conclusion

Through this piece, we hope to provide a look at how Elemental’s pipeline of climate tech companies has developed over time. While we acknowledge that our data set is a non-random sample of startups that have applied to our program, we also expect that these themes can tell us something about the climate tech industry as a whole. By looking back, we can better anticipate the coming trends and needs of climate tech innovation and continue to serve and support the companies leading the charge in our collective climate fight.

• • •

Thank you to all the folks who contributed time and insight to our search, including our dealflow partners, Elemental Navigator members, the Elemental Startup Scouts, our community representatives and partners, our portfolio founders members, government leaders and many more. And thank you to the companies who applied and considered us a potential partner. Elemental exists because of your efforts and we look forward to continuing our mission of supporting your important work.