You may have caught the news that we spun out a new venture fund. It’s called Earthshot Ventures. Don’t worry, we’re not closing Elemental Excelerator’s doors; in fact, we’re growing here too!

The press release covered a lot, but maybe you’re wondering WHY and how we raised a venture capital (VC) fund. Here are 5 things we left out of the press roundup.

One: Why a venture fund, and why now?

After all, as a nonprofit we have invested $43m in climate solutions over the past decade, and, as we laid out in our Five Year Strategy, we’re expanding the ways we help more entrepreneurs grow wings, the range of partners we’re navigating toward decarbonization, and the scale of action we’re hoping to inspire. So, why now?

The answer is equal parts responsibility and opportunity. The responsibility is to help more ingenious founders succeed beyond the Elemental portfolio, to build on what we’ve learned, and to draw more people into solving climate change. And the opportunity is to more deeply engage in the biggest growth industry of our lifetime as we accelerate down the one-way street to decarbonization. We’re convinced that Elemental and Earthshot together will multiply our impact on climate x social equity.

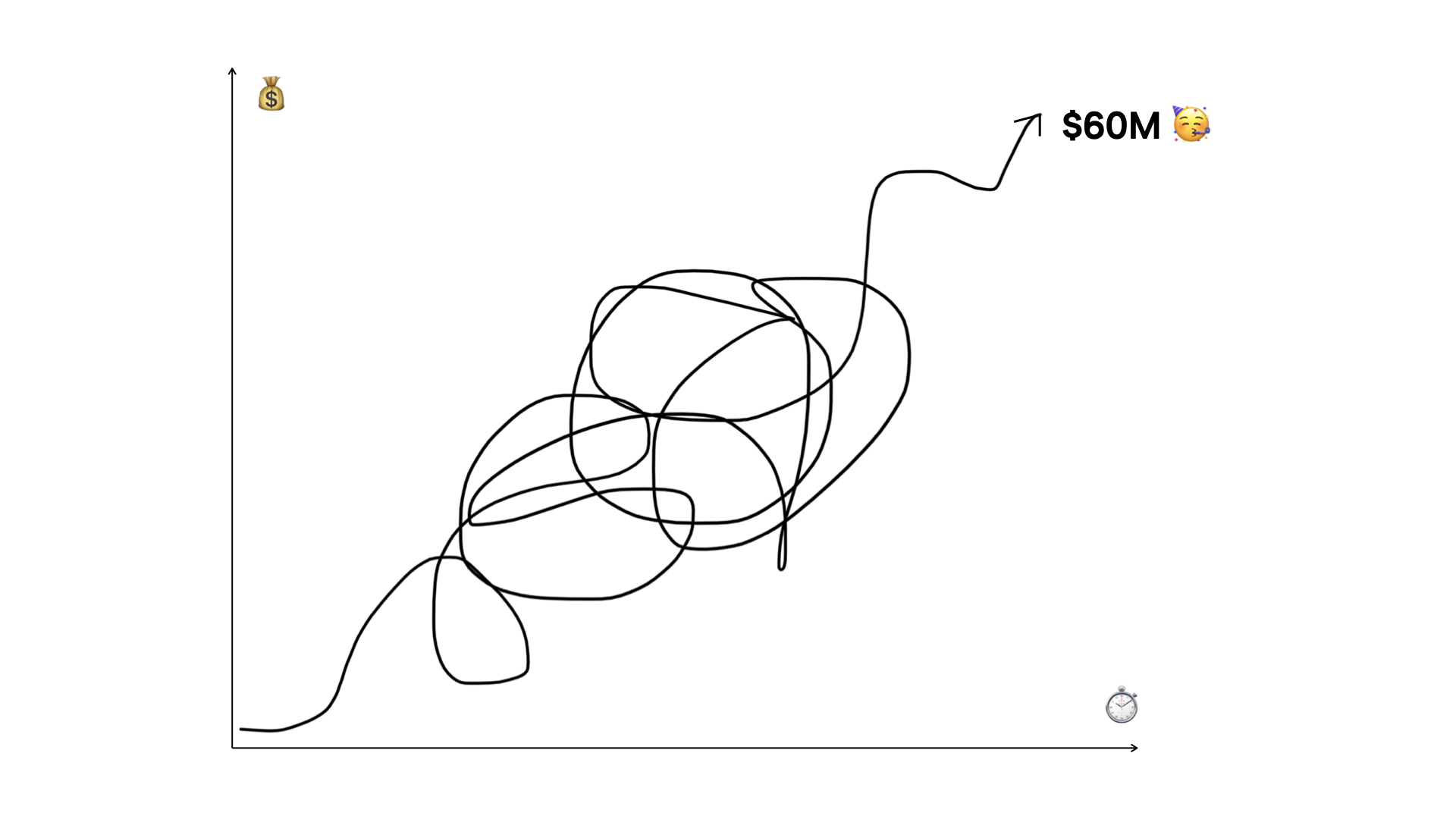

Two: Fundraising was hard. But I really enjoyed it.

When I played competitive soccer, I loved taking penalty kicks. It was the pressure, the buildup, and the clarity of the zero/one outcome. I enjoy those same things about fundraising — and the ability to get right to the heart of what matters to people, and how much it matters. I’ll be honest; unlike Chris Sacca, who I’m a big fan of, Earthshot took longer than a few days to raise. To raise this fund, we took a lot of penalty shots. You can’t make the shots you don’t take, right? The journey looked something like this.

Three: Leaning into our unfair advantage.

There’s a saying in VC land that you need to exploit your unfair advantage. We knew that our decade of experience investing in climate tech companies — through an era when most VCs ran from the space — and deploying projects in real communities, provide an unfair advantage. Yet even though we’ve been investing in climate companies for over 10 years and our companies have seen a lot of commercial success, Elemental is not a traditional investor by any stretch of the imagination.

So we had to tell a story about how the experience of Elemental combines with Earthshot Managing Partner Mike Jackson (MJ)’s venture experience to create a new kind of magic. We boiled this magic down into a few things: our ability to leverage Elemental’s team of 35+ climate innovation superstars; our 25+ corporate funders and collaborators who serve hundreds of millions of customers; our experience with blending non-dilutive funding and project finance to boost venture returns; and the 2000+ people and funds that we’ve co-invested alongside over the last twelve years.

Four: A nursery is (enough of) an acceptable office.

We only took one meeting in person. Because we started fundraising almost a year into the pandemic, MJ and I did not travel to meet investors. But we were still fortunate to be able to build a limited partner roster with people and companies from Anchorage, London, New York, San Francisco, Seattle, Tokyo, and many places in between.

My daughter Lily’s nursery became my Honolulu HQ and MJ turned his barn in Maine into our East Coast HQ. On the positive side, we both spent a lot of time with our young kids, reduced our carbon footprints by >80%, and still had the privilege of launching this fund with some of the people we admire most in investing and technology. We feel enormously fortunate for all three.

Five: Be clear about the why. Hint: the answer is in the name.

No, Earthshot Ventures is not named after the Earthshot Prize. So, where did the name come from? Our inspiration is captured in this 2018 film created by Elemental’s very own Bobby Bailey. We titled it The Earthshot, and the concept stuck. You hear Nainoa Thompson, a master navigator who has dedicated his life to learning and teaching ancestral ways of voyaging, say, “This is our Earthshot.” He’s referring to people who have the audacity to try something new, and the courage to take risks even if they may fail. He also means that right now is our one chance to save our planet, just as the IPCC has made very clear. It’s this conviction that is at the center of our “why,” and gave us the clarity to say no to investors who didn’t align with us.

So that’s the story! It has twists and turns, but from the beginning we’ve been a quirky collective of individuals on a mission to redesign the systems at the root of climate change. While I’m tempted to check this off the list and get back to work, now is also a good time to take a moment to celebrate, so… cue the dance party (and everyone’s invited because it takes a village)!

— Dawn & the inimitable Earthshot team 👇🏽