When people hear “accelerator,” they often think of programs like Y Combinator, 500 Startups, and Techstars. These tech accelerators, which helped launch startups like Airbnb, Dropbox, and Instacart, are positioned to take ideas and create companies out of them through seed-stage funding and support. There is another breed of accelerators designed to help startups operating in capital-intensive markets cross their second and third “valleys of death.” These companies need patient capital, longer timelines, and support over multiple years as they continue to grow their businesses. This is particularly relevant in industries — such as energy, water, agriculture, and mobility — that transform the way we live.

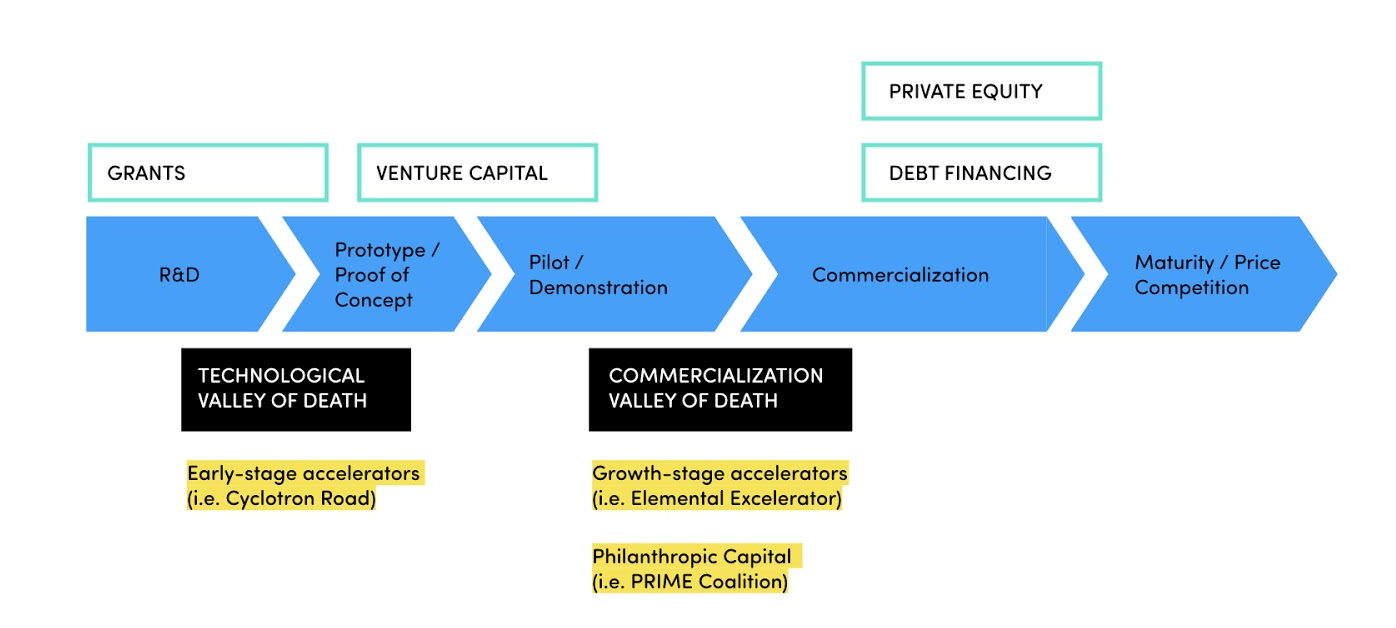

The Breakthrough Institute published a white paper in 2011 explaining the two gaps in funding that test the survival of startups with world-changing ideas:

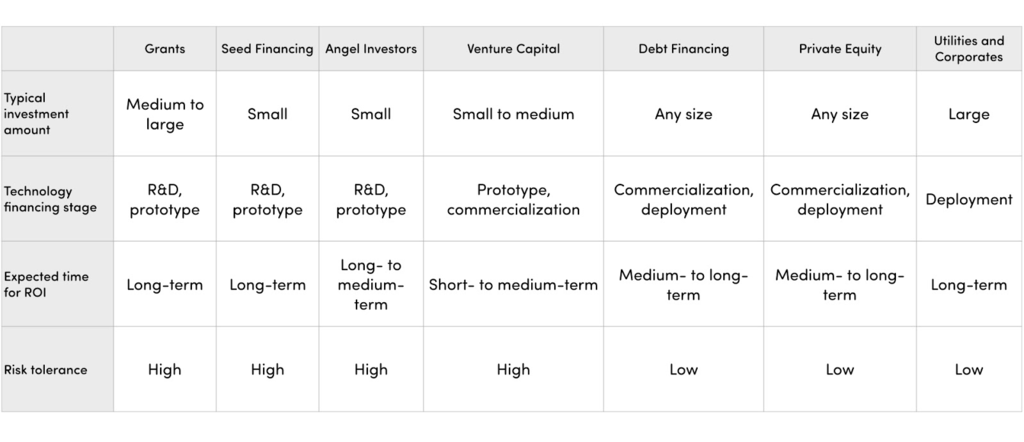

1. The first gap is called the “Technological Valley of Death.” At this stage, companies are still developing their technologies and business models as they get ready to raise a first round of institutional capital.

Source: Jesse Jenkins and Sara Mansur, “Bridging the Clean Energy Valleys of Death,” Breakthrough Institute, November 2011

2. The second gap occurs when startups are seeking capital to fund commercial-scale projects. The Breakthrough Institute calls this the “Commercialization Valley of Death.” Venture capitalists can tolerate moderate technology risk but not the larger check size, while traditional financiers are comfortable writing large checks but not funding technology risks.

Source: Jesse Jenkins and Sara Mansur, “Bridging the Clean Energy Valleys of Death,” Breakthrough Institute, November 2011

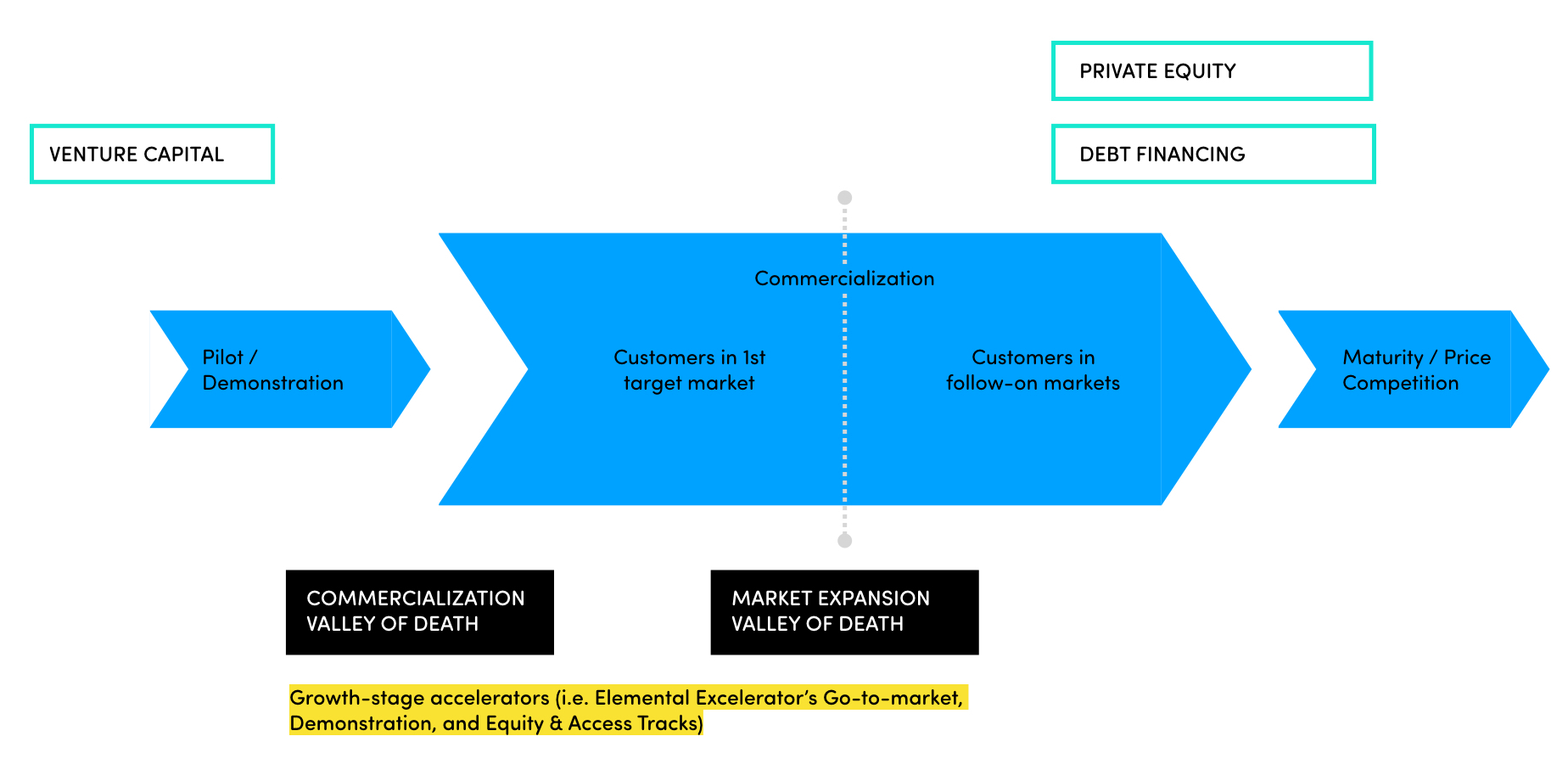

3. We have observed a third valley of death — when startups attempt to expand and scale into new markets. This could mean new geographic markets or new customer segment, such as expanding from the U.S. to Japan or from military customers to utilities.

Elemental Excelerator is one of the growth-stage accelerators helping to fill the capital gap between pilot and commercialization during this stage. In 2012, Elemental Excelerator’s CEO, Dawn Lippert, and COO, Jill Sims, traveled the nation in search of the right model to support startups with solutions to climate change. They started with grant funding from the Department of Energy and, a little later, the U.S. Navy. By interacting with dozens of entrepreneurs, investors, and corporates, they realized that funding was not enough. They combined elements of seed-stage accelerator programs like Y Combinator and Techstars to build a customized ecosystem around each portfolio company that includes investors, partners, and peers who can help each startup grow quickly in its own unique way.

At Elemental Excelerator, we ask our Demonstration-track applicants to apply with a transformational project in mind. The idea is that we bridge the third valley of death by subsidizing a substantial project to prove out the next generation of their technology, test an expansion on their existing business model, or subsidize the risk of entering a new customer segment or geography. Our most successful companies have identified the barriers that stand between where they are now and what it will take to fully commercialize their technology. We work with these companies to structure a project that will serve as the best case study for future clients and accelerate their path to market. Companies that are in this stage of growth tend to be more mature. In our last round, applicants had between 2 to 30 full-time employees, an average of $1.9 million of outside capital raised, and an average of $298,000 in revenue.

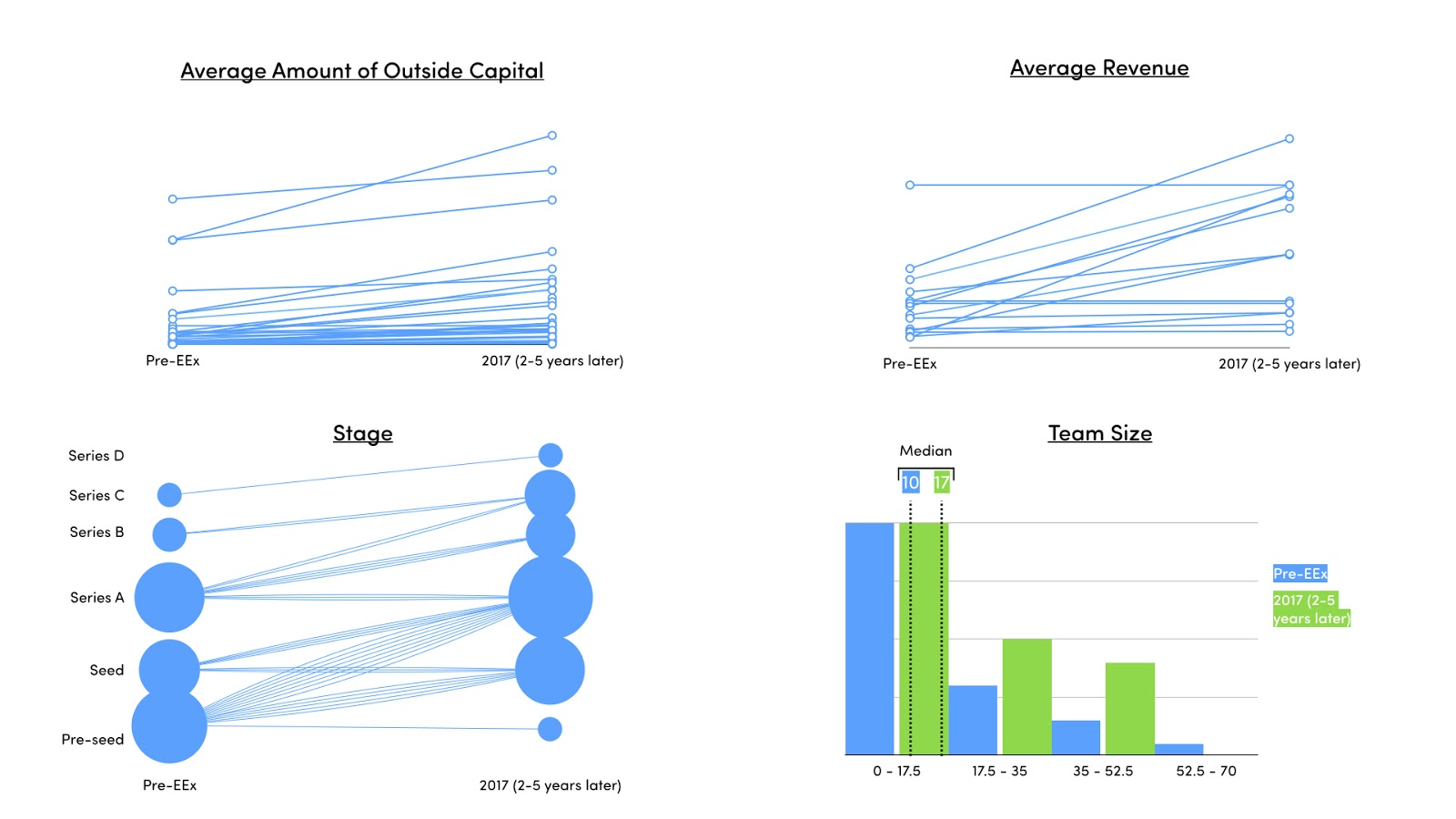

In addition to the standard metrics of success for accelerators (i.e., ratio of active to inactive companies and follow-on funding), growth-stage accelerators also track revenue. Elemental Excelerator measures company growth and portfolio success in five primary ways:

- Revenue generated – $110 million

- Follow-on funding – $350 million raised, companies fall between pre-seed to Series D

- Funding awarded – $22 million awarded by EEx to 63 portfolio companies

- Capital unlocked for innovation – $12.3 million of cost share for demonstration projects from utilities, building and land owners, agricultural operations, government agencies, and other local businesses

- Team size – 995 total full-time equivalents

Metrics are from Elemental Excelerator portfolio companies in 2017

“Startups typically apply to an accelerator when they need a certain type of funding. But, like in life, money is just a means to an end. Building a company isn’t about raising the most money, it’s about getting your solution into the hands of the right people, so that it can change the world,” says Naveen Sikka, CEO of agtech startup TerViva. “Accelerators like Elemental Excelerator provide so much more than funding. To truly be a growth accelerator, you need the right type of capital that can tolerate moderate technology risk, and have the right relationships and resources for companies that want to commercialize. It’s that dual value proposition that helps companies like TerViva cross the ‘Commercialization Valley of Death’ on their path to scale.”

The world needs more investible startups in energy, agriculture, water, and mobility to achieve rapid decarbonization. By bridging the valleys of death with our funding, partnerships, programming, and investor connections, we are creating a wider pool of investible opportunities that fuel the clean economy and help us fulfill our mission.

Ramsay Siegal

Head of Partnerships & Pipeline

Elemental Excelerator

Head of Partnerships & Pipeline

Elemental Excelerator