One of our favorite days of the year is approaching fast — when we get to share our next cohort of world-changing startups with you. We’re wrapping up our due diligence process right now, so keep an eye out for an announcement next month. In the meantime, we wanted to offer a quick peek into this year’s dealflow.

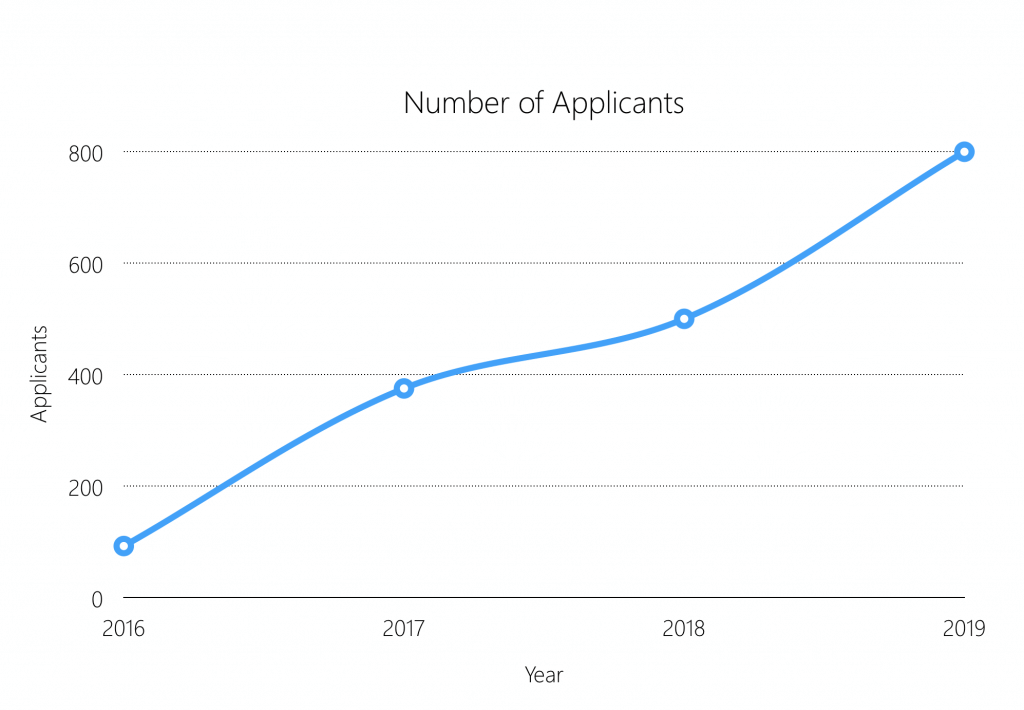

As always, there are far more amazing companies than we could possibly select for our eighth cohort. In fact, this year, nearly 800 companies applied to our program, which we estimate is roughly 20% of the active startups in our verticals (based on Pitchbook data). What can we learn — about the state of the clean technology ecosystem, and our place in it — by investigating this pool of applicants as a whole?

First and foremost…

800

… startups applied this year. This is a 60% increase over 2018 numbers.

Out of those 800 companies we’ll select 15-20 to be in our next cohort, for an acceptance rate of under 2.5%. We are heartened to see that so many companies are interested in working with us. But even more than that, we’re incredibly optimistic that the entrepreneurial ecosystem is thriving and rising to the challenge of creating a cleaner future.

66

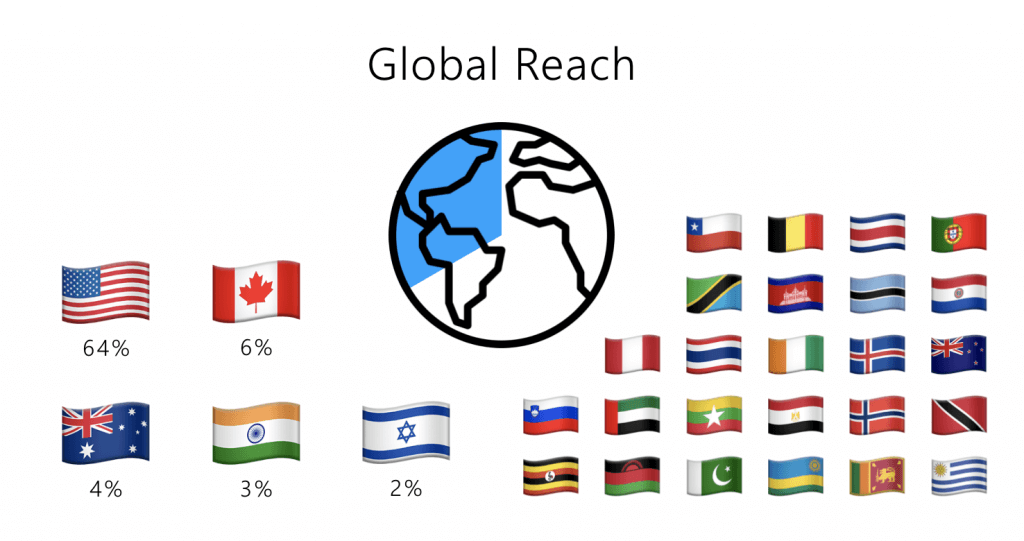

… countries represented in the applicant pool. That’s over a third of the planet right there, not that anyone’s counting. OK true, we’re counting.

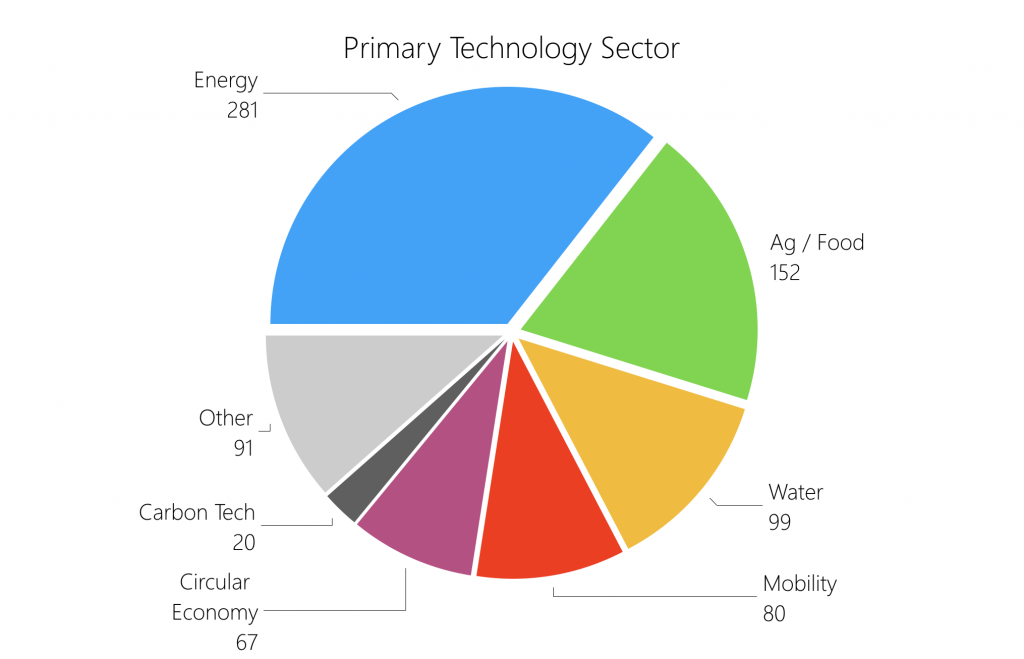

53%

… water, mobility, agriculture, and circular economy companies.

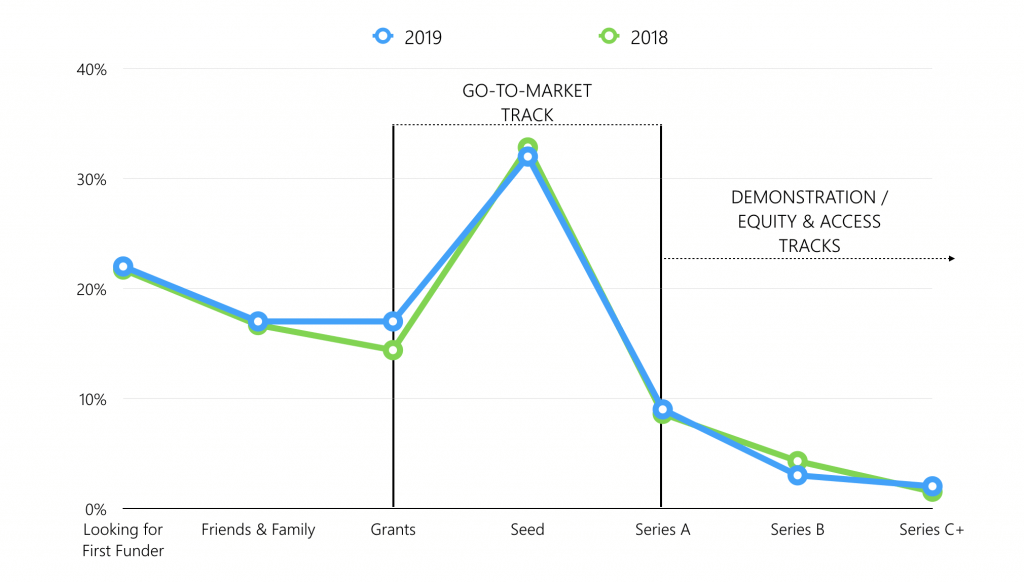

44%

… of the applicants are in the Seed to Series C+ funding stage, our sweetest spot. We typically work with Grant to Seed-stage companies through our Go-to-Market track, while startups who have raised a Series A or B round typically land in the Demonstration and Equity & Access tracks.

What surprised us here? How even with 60% more companies, the distribution is consistent. This affirms our experience that there are many very promising seed-stage startups, with limited funding opportunities to fuel their growth.

81 & 67

We’ll leave you with just two more data points: 81% of companies have technologies that lead directly to greenhouse gas reductions, and 67% indicated that their technologies have specific applications in low-income communities. This tells us that we are reaching like-minded companies who are driven to address climate change and ensure that the environment and communities can thrive together.

Interested in more insights about the technology trends we’re seeing in energy, mobility, agriculture, water, and the circular economy? Be sure to get in touch with our team.